YEG REAL ESTATE RESULTS DECEMBER 2023 AND 5 YEAR STATS – JFSELLS.COM

Posted by John Fraser on

YEG REAL ESTATE RESULTS DECEMBER 2023 AND 5 YEAR STATS – JFSELLS.COM

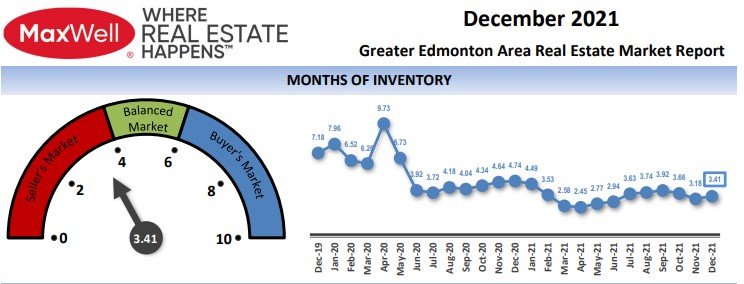

2023-12_Edmonton_2 year view Statistics MAX

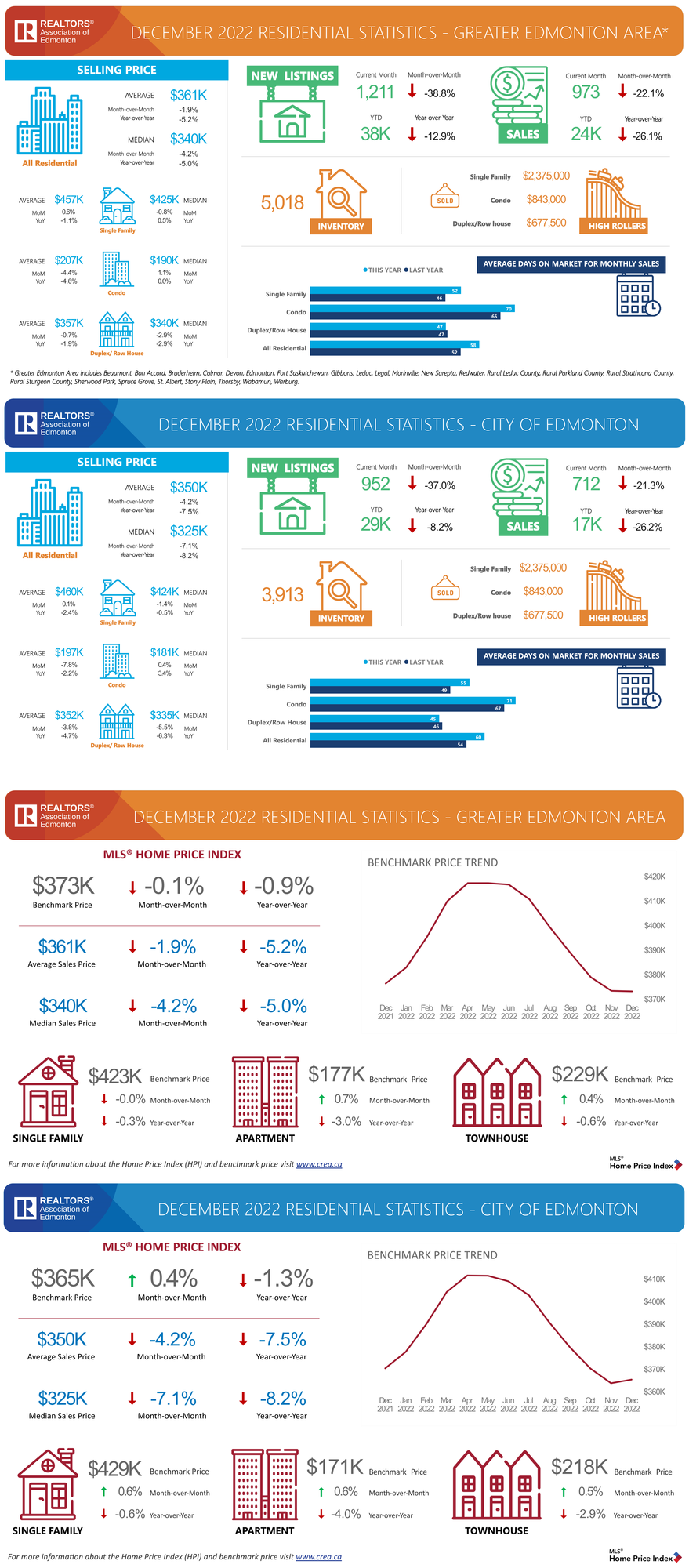

DECEMBER Edmonton AREA 2023_MonthlyStats

DECEMBER_2023_YEG Media Release RAE stats

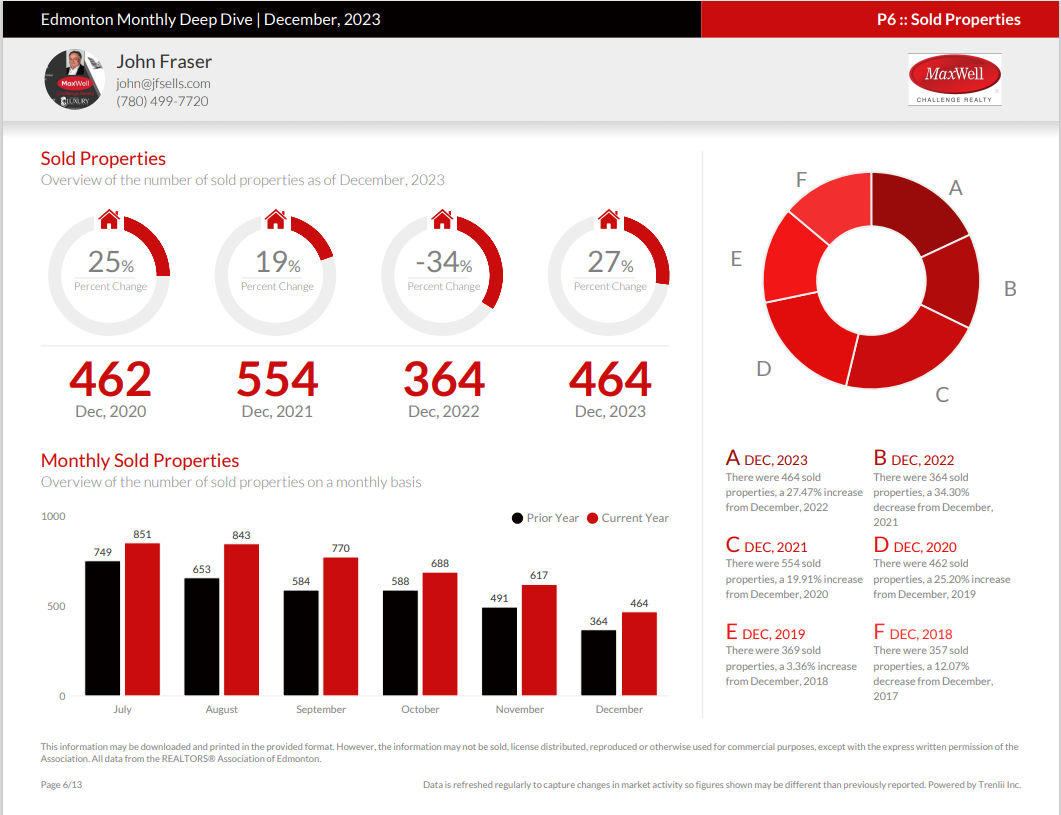

DECEMBER_2023_CREA-EDMO 5 full year stats

86 Views, 0 Comments